Treasurer

Click Each Section Below to View More

Training

Kicking Off 2024-25!

3. Treasurer Group Chat – I have created a Treasurer group chat on Signal for ease of communication. To join, download the Signal App and join with this link or scan the following QR code. This chat is for questions/comments that may arise throughout the year. You can always text me separately anytime.

Do's & Don'ts Reminders

As Treasurer, you often need to remind your exec board and association of what is allowable per IRS rules and guidelines. Take a moment during your first meeting the year to remind them of the following:

Do’s

- If gift cards/certificates are something you’re seeking, ask them to be donated

- Have 2 check signers for every check issued

- Use a Fiduciary Agreement when gifting/granting money to school

- Ask for original receipts for reimbursements

- Follow the 5% rule for hospitality including Staff Appreciation and keep hospitality expenses 5% or lower than your total annual expenses

- Communicate a set time period (usually 90days) in which all reimbursement checks should be cashed otherwise funds return to PTA general fund

Don’ts

- Do not PURCHASE gift cards/certificates with PTA funds

- Do not purchase PERSONAL GIFTS with PTA funds for teachers, staff, students, families or PTA Board

- Do not encumber future boards with finances or contracts

- Do not sign a contract on your own. All contracts must be approved by the association and signed by 2 elected officers -one being the President

Financial Forms & Websites

Our Council Annual Assessment is $60 this year. Please note this in your budget as well and include your Annual Assessment, payable to Irvine Unified PTA, with your first remittance. Additionally, your membership dues are due to Council before or on the date of each monthly council meeting. Please coordinate with your President and VP Membership for accurate and timely remittances.

Kick-off – What we need from all units at start of new year!

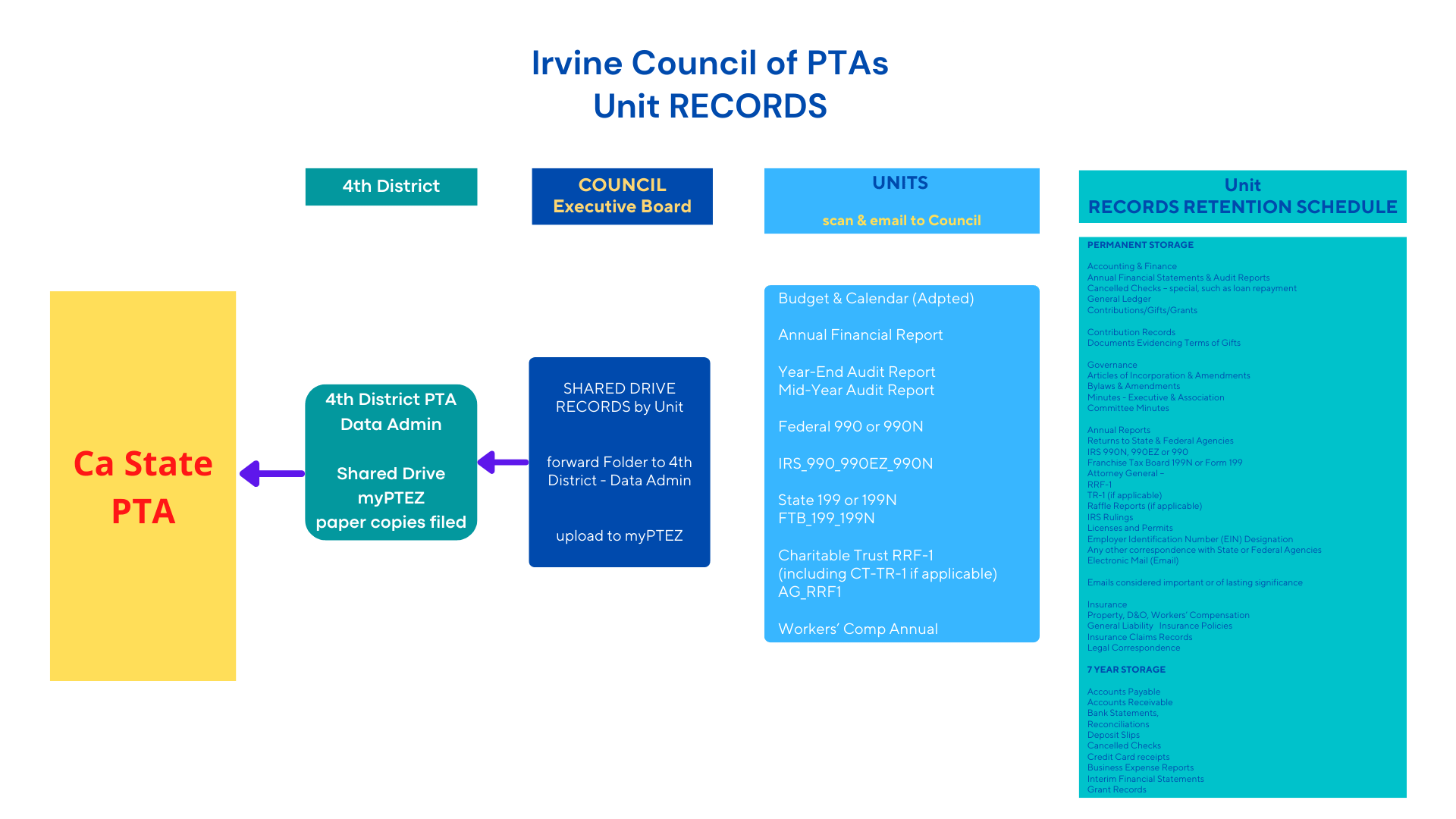

Please email to council treasurer your 2022-2023 Annual Financial Report and your 2023-2024 Budget Report once they have been presented and your budget has been approved and adopted at your Executive and Association meetings. We will upload them to myPTez. Your President may also upload them into myPTez.

Planning a Raffle?

If your PTA plans to host a raffle, your unit is required by the state of California to fill out forms CT-NRP-1 and CT-NRP-2. CT-NRP-1 must be filled out 60 days prior to your raffle. It might be wise to file one even if your PTA is unsure of holding a raffle or not. Please consider an opportunity drawing (not selling a chance to win something) in place of a raffle. Remember, in no instance are you allowed to sell and distribute raffle tickets online.

- Link to California, Attorney General: Non-profit Raffles Website

- Link to the Application for Registration, Non-profit Raffle Program Form

Registry of Charitable Trusts Link

Tax Forms

The tax filing deadline is November 15, 2023. Forms to file are: 990, 199, and RRF-1 (along with CT-TR-1 if your income is $50,000 or less). More information will be emailed once we get closer to the date.

- 990N

- 990EZ

- 990

- Schedule A

- Schedule O

- 199N

- 199

- RRF-1

- Annotated RRF-1

- Charity Registration Online Renewal System

- 8868

- CT-TR-1

- Annotated CT-TR-1

- Sample IRS W-9 form

- Fillable IRS W-9 form

Insurance

Your unit insurance premium for 2023-2024 is $282. Please make a note and reflect this in your budget. You will receive an email from AIM in the fall with a link to their payment site. Confirm with your unit president that your treasurer email is updated in myPTEZ.

- PTA Member Participation Waiver*

- Volunteer Waiver for Adults

- Volunteer Waiver for Students

- Hold Harmless for Vendors

- AIM Insurance Guide – Complete

*required for ALL PTA members – include in your welcome packets or online forms

Tools & Resources

CaPTA Toolkit has now been replaced with the NEW CaPTA Leaders Website, so please register a login and access that for all your PTA procedures and questions about everything PTA!

myPTEZ

MembershipToolkit